Why Blackstone for Private Equity? / Overview of Blackstone

- Josh Rovner

- Oct 17, 2022

- 2 min read

Updated: May 30, 2024

If you're interested in breaking into finance, check out our Private Equity Course and Investment Banking Course, which help thousands of candidates land top jobs every year.

Overview

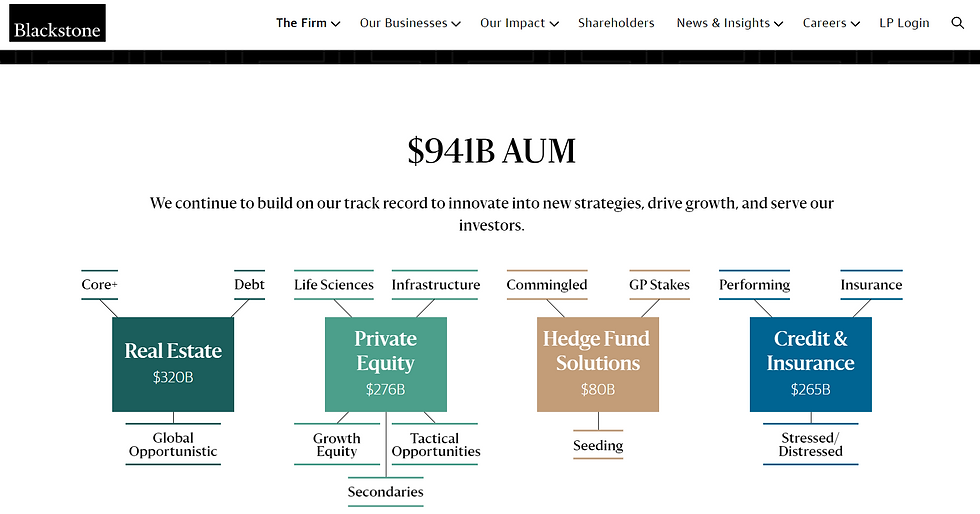

Blackstone is one of the world's largest asset managers and most respected investors. Blackstone has 24 offices worldwide and an AUM of over $1T, spanning multiple asset classes.

Blackstone has several funds and investment strategies, including Private Equity, Real Estate, Hedge Fund Solutions, and Credit & Insurance. In Q3 2022, Blackstone completed the raise of $24B for its tenth real estate fund. Blackstone's latest private equity fund closed in 2019 is an industry-leading $26B.

Blackstone was initially founded as an M&A advisory boutique investment bank and would move to investing in private equity and other asset classes thereafter. Blackstone has since spun out its M&A operations, which formed the investment bank PJT.

Remember that in order to craft a great answer to the common question "Why this Firm?", it's your responsibility to read articles and speak with employees. If you are interviewing with Blackstone, you should make sure you know:

1 deal that the investment team you are recruiting with has done

1 person at the firm (ideally someone who would have influence over your recruiting process)

1 business model-specific detail to mention

We explain how to answer qualitative questions and research private equity firms in our Private Equity Course. We also teach how to build LBO models and prepare for case study interviews.

Selected Transaction

Blackstone acquired Crown Resorts, an Australian casino operator. Operating in Melbourne, Perth, and Sydney, the company had a history of tension with regulators due to alleged money laundering practices.

Transaction Description: The Blackstone Group Inc. (NYSE:BX) made an offer to acquire the remaining 90% stake in Crown Resorts Limited (ASX:CWN) from James Packer and others. Under the terms of the consideration, the shares will be acquired for cash payment of AUD 11.85 per share.

Transaction Value: US$6.3B

Transaction Date: Closed June 2022

Fact Sheet

Company Name: Blackstone

Description: Blackstone is a leading global investment business investing capital on behalf of pension funds, large institutions and individuals

Firm Category: Private Equity / Asset Manager

Ticker: NYSE:BX

Founded: 1985

Employees: 3,800

Assets Under Management: $1T

Flagship Fund Size: Blackstone Capital Partners Fund VIII ($26B raised in 2019)

Chief Executive Officer: Stephen Schwarzman

Headquarters: New York City, USA

Resources

Based on the H1B Database, the average base salary for a Private Equity Analyst at Blackstone is $90k - $150k. We note that this salary information may be dated and not reflective of their current pay.